Driving Behaviour and Telematics Data-Based Vehicle Insurance Developed for Toyota’s Connected Cars

A new vehicle insurance based on the way the driver behaves at the wheel and data gathered from an on-board telematics system is being made available for drivers of Toyota’s connected cars1. Premiums are partly calculated on the level of safe driving recorded each month.

The first insurance of its kind to be offered in Japan, it has been jointly developed by Toyota Motor Corporation, and Aioi Nissay Dowa Insurance, part of the MS&AD Insurance Group.

Under this new plan, up to 80 per cent2 of the usage-based premiums can be discounted. In addition to discounts for good driving, additional, future services will be offered, themed under Enjoyment, Benefits and Safeguards.

The new service is due to go on sale next January, with insurance liability scheduled to start in April 2018.

Both Toyota and Aioi Nissay Dowa Insurance want to help realise a safe and secure traffic environment by developing and providing telematics car insurance that makes use of the opportunities provided by connected cars and automobile big data.

The service and its features

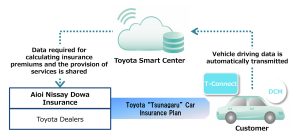

Toyota’s connected cars automatically transmit a range of car-related data via a data collection module to the Toyota Smart Center. Aioi Nissay Dowa Insurance will use this information to provide its new service, the Toyota Tsunagaru car insurance plan, unique to Toyota vehicles.

Insurance plans have typically focused on giving customers peace of mind if they are involved in a traffic accident. But by designing a service that makes use of telematics technologies, Aioi Nissay Dowa Insurance aims to generate added value for people who are safe drivers.

The company gives each customer a prompt safe driving diagnosis and provide them with driving score and tips after each journey they make. The driver’s speed, acceleration and braking are all marked on a five-point scale and a combined score out of 100 is produced. A report map lets users check the route taken and the locations where any dangerous driving was detected. The system can also provide alerts about the operational status of the car’s active safety devices, tyre pressures and other functions.

According the model of car, the customer will receive a monthly report with a detailed evaluation of their performance, information on any insurance premium discount offered and advice on safe driving.

The scheme will develop to provide an Entertainment element in which customers will also be shown their national ranking in terms of their safe driving score and how they compare to drivers of like model and age in their region.

1 Vehicles equipped with navigation systems from which Toyota can collect driving data, and which can connect to the internet. 2 Full premium discount rate depends on annual mileage.